Bitcoin explodes past $109,000 in new all-time record — What’s driving the massive rally?

Bitcoin surged past its January peak on Wednesday, boosted by macroeconomic factors, rising ETF inflows, and anticipation around crypto regulation.

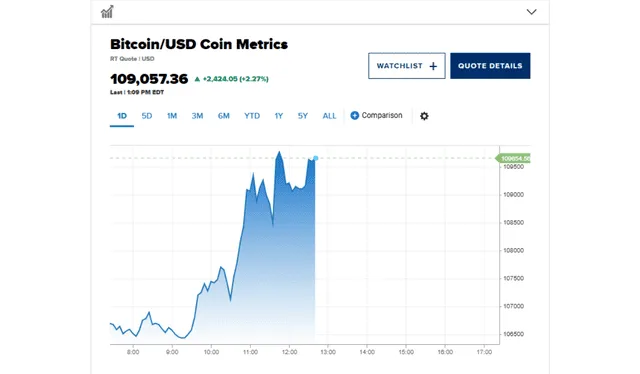

Bitcoin reached a new all-time high on Wednesday, climbing to $109,500 and surpassing its previous record set in January. According to Coin Metrics, the cryptocurrency was last up 2% at $108,955.10. The recent rally comes as optimism grows around macroeconomic shifts, softening inflation, and advancing U.S. crypto regulation.

Antoni Trenchev, cofounder of crypto exchange Nexo, attributed the surge to a combination of favorable conditions including lower inflation in the U.S., a de-escalation in the U.S.-China trade conflict, and Moody’s downgrade of U.S. sovereign debt. “We’ve entered an alternate universe very different from early April when global macro concerns were at their peak and bitcoin slumped to $74,000,” Trenchev said. “It’s possible a three-month window has opened for risk assets to thrive.”

ETF inflows and corporate holdings support momentum

The price increase also reflects growing investor demand and inflows into bitcoin-linked exchange-traded funds. Cumulative inflows into bitcoin ETFs surpassed $40 billion last week, with only two days of outflows recorded in May, according to SoSoValue. On-chain data from CryptoQuant indicates decreased selling pressure, while liquidity is rising, shown by record levels of the Tether (USDT) stablecoin on exchanges.

Bitcoin’s momentum is also being supported by institutional participation. Corporate holdings of bitcoin have increased 31% year-to-date, with publicly traded companies now controlling about $349 billion worth of the asset — nearly 15% of its total supply, according to Bitcoin Treasuries.

Bitcoin hits a new record high, surpassing $109,000. Photo: CNBC

Regulatory developments add to industry confidence

The Senate recently advanced legislation that would establish the first U.S. regulatory framework for stablecoins, marking a significant shift in Washington’s stance on digital assets. President Donald Trump has expressed interest in signing a crypto regulation package before Congress goes into August recess.

Meanwhile, Coinbase’s recent addition to the S&P 500 has been celebrated as a turning point for the industry. Together, these developments are signaling growing mainstream acceptance and institutional confidence in the future of crypto assets.