$WLFI: The Trump-linked Cryptocurrency raising ethical concerns in the U.S.

Touted as the “Trump-backed stablecoin,” WLFI is shaking up the crypto world, but behind the buzz lies a storm of ethical red flags, foreign ties, and fears of political manipulation in the digital age.

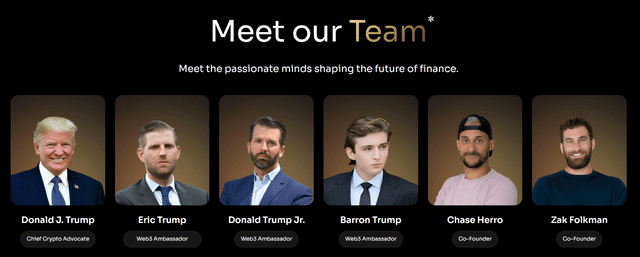

World Liberty Financial (WLFI) is a cryptocurrency initiative tied to U.S. President Donald Trump, generating intense ethical concerns in the U.S. financial and political spheres. WLFI launched a stablecoin called USD1, promoted as a tool for global financial freedom. However, critics argue the project may primarily benefit Trump’s personal and political interests, blurring the line between public service and private enterprise.

Trump and his family reportedly hold a 60% stake in WLFI, raising questions about the use of political influence for financial gain. The company recently signed a $2 billion investment agreement with MGX, a UAE-based group, allowing the use of USD1 to purchase U.S. Treasury bonds. This deal may generate significant annual profits, thanks to interest from government securities, fueling further controversy.

Trump-linked WLFI raises concerns over market manipulation and foreign ties

Observers warn that Trump’s endorsement of WLFI, combined with his political presence, could distort market dynamics and invite foreign interference. The project’s global ambition and Trump’s public promotion raise alarms over potential misuse of power, especially as he campaigns for a return to the presidency. Critics fear WLFI is less about decentralization and more about political financing.

Another concern is WLFI’s potential exposure to risky partners. Some foreign investors in the venture have been investigated for financial crimes. This raises red flags about due diligence and the possibility of cryptocurrency being used as a cover for illicit financial flows. The Trump brand's association provides legitimacy, even if risks are high.

WLFI sparks debate on Crypto’s role in politics, ethics, and campaign finance

Ethics experts believe WLFI exemplifies the danger of combining politics, business, and emerging technologies without proper regulation. The stablecoin could become a soft-power tool or even a fundraising instrument in future campaigns. Meanwhile, transparency remains limited, and watchdogs have urged lawmakers to scrutinize the venture closely.

Donald Trump heads $WLFI as Chief Crypto Advocate, joined by his sons, while co-founders Folkman and Herro bring a history of questionable ventures. Photo: World Liberty Financial

In the broader context, WLFI’s rise has sparked debate about the role of cryptocurrency in modern politics. As regulations lag behind innovation, WLFI may set a precedent for how political figures exploit financial technology. Whether it succeeds or fails, the project raises serious questions about accountability, conflict of interest, and the future of democratic integrity.