Stocks fall after Trump accuses China of breaking Geneva trade deal, warns of tough response

Trump’s Truth Social post sparks market drop; China accused of violating May 12 tariff rollback deal

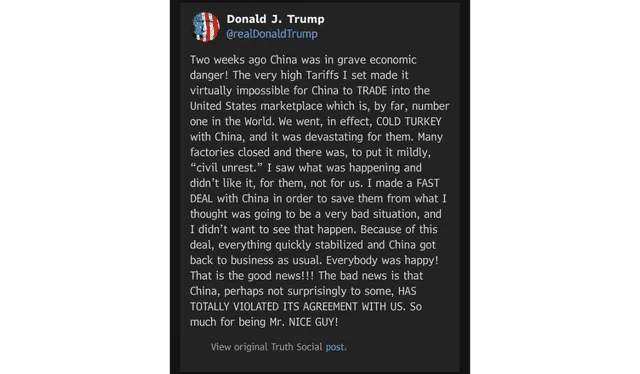

Trumps statements began to take hold around 8 ET on Friday, leading U.S. stocks to decline on Friday morning. "If China thinks that I meant the Geneva Agreement is just the setup for future trade agreement talks, they are totally wrong…." Trump, asserting that he would change his approach to trade going forward.

The agreement was announced by the White House on May 12, wherein both countries agreed to reduce certain tariffs by 115% over a period of 90 days. Markets had expressively welcomed the announcement, especially since it was a reciprocal agreement whereby China announced it would suspend certain retaliatory measures. Slipping - Impression begin to soften and markets opened about .4% lower across all major U.S. stock indexes.

U.S. officials signal frustration over trade compliance

On Friday morning's interview on CNBC, U.S. Trade Representative Jamieson Greer reiterated concerns the same as those of the president, stating that China was "slow rolling their compliance," which he said "was totally unacceptable," and stated that if the negotiations are going to be delayed, there are real economic ramifications.

Treasury Secretary Scott Bessent also acknowledged stalled negotiations with China. On Thursday he noted that if the negotiations were to continue, it would likely have to come from President Trump and Chinese President Xi Jinping directly. Compounding the situation is an appeals court's decision to reinstate certain tariffs that have muddied an already liquid situation.

Trump claims on his Truth Social account that China broke the Geneva agreement. Photo: Reddit

Economic data adds pressure to market sentiment

A new report released on Friday found that U.S. consumer spending had decreased considerably from the previous month (0.7% in March, to 0.2% in April). Analysts at Fitch Ratings related the decrease to increased economic uncertainty, especially as a result of the continuing trade tensions, while also noting the highest savings rate since May 2024.

Despite inflation data in the report being considered positive, Fitch argued that the Federal Reserve will likely maintain caution. Both the existing economic climate, and the volatile trade developments had the potential to shape the Feds interest rate strategy for the future.