Good news for Tesla: The company’s stock breaks key resistance level ahead of robotaxi launch, offers aggressive buy signal

Tesla shares rally past the 200-day moving average as investors anticipate Tesla's robotaxi debut in June, despite mixed earnings and broader market volatility.

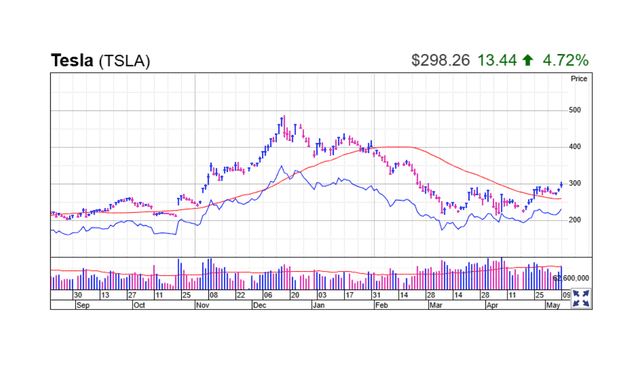

Tesla shares surged 4.7% on Friday to close at $298.10, breaking above their 200-day moving average and triggering a potential buy signal for aggressive traders. The move comes just weeks ahead of Tesla’s highly anticipated robotaxi reveal, scheduled for June in Austin, Texas.

According to technical analysis from MarketSurge, Friday’s rally lifted Tesla above key resistance levels, with traders eyeing the May 2 high of $294.86 as a potential entry point. However, the stock remains well below its December 18 high of $488.54, and Friday's intraday peak of $307.04 was pared back as the broader market gave up early gains.

ALSO SEE: Zoox robotaxi recall: Amazon issues software update after Las Vegas collision incident in April 2025

Trading setup and market sentiment

Despite recent volatility, Tesla has climbed nearly 40% since hitting a low of $214.25 on April 7. Investors can use Thursday’s low of $279.41 as a stop-loss level, while closely watching for further signs of strength as the stock navigates overhead resistance.

Tesla’s strong performance follows a 26% post-earnings rebound, despite reporting a 40% year-over-year decline in Q1 profit and withdrawing its 2025 delivery growth forecast. Investor optimism has been buoyed by Elon Musk’s renewed focus on Tesla and growing enthusiasm for its upcoming autonomous vehicle program.

Tesla shares rose 4.7% to 298.10 on Friday. This placed them above their 200-day and multi-week moving averages. Photo: Investor's Business Daily

Robotaxi anticipation drives optimism

CEO Elon Musk confirmed that Tesla is on track to launch its first robotaxis in June, though final design details are still under discussion. He noted that the initial rollout may include 10 to 20 vehicles on launch day. The announcement has fueled bullish sentiment, even as Tesla continues to navigate pressure from declining margins and competition in the EV space.

Tesla stock currently holds a 21-day average true range (ATR) of 5.96%, indicating high volatility. Its Composite Rating from Investor’s Business Daily (IBD) stands at 68 out of 99, with a Relative Strength Rating of 86 and an EPS Rating of 59. The stock is still down 26% year-to-date and remains 39% below its December peak, but technical indicators suggest growing momentum tied to the robotaxi catalyst.