Will there be a Stimulus Check in 2025? Update on Trump’s stimulus efforts

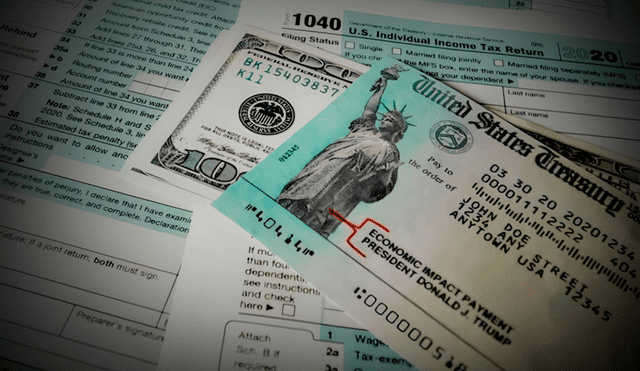

Deadlines for claiming the first three stimulus checks have passed, including the April 15, 2025, cutoff for the third check. Rumors of a fourth stimulus remain unconfirmed, while taxpayers seek updates on refund status and recovery options.

With the deadline of April 15, 2025, now in the rear view, many Americans still find themselves wondering about stimulus payments— whether they failed to claim past checks, or whether they will receive a new stimulus check. Questions continue to circulate about eligibility status and a possible future stimulus.

Despite rumors or speculation on the internet, there have been no official announcements regarding a fourth stimulus check, but taxpayers are encouraged to remain informed about refund claims and their deadlines to prevent losing out on funds.

When was the last time to file a stimulus check?

The deadline to file for the third and final stimulus check was April 15, 2025, which marked the three-year deadline to claim any tax refunds or, in this case, the $1,400 Recovery Rebate Credit for that year—2021.

Even if you received a tax extension, you still had to file your 2021 tax return by the April 15, 2025, deadline to claim that third stimulus check. There's no extension or appeal for missing the deadline, and all unclaimed stimulus payments become the property of the U.S. Treasury.

In February, President Donald Trump mentioned that he would be considering the idea of taxpayers receiving $5,000 stimulus checks in the form of a "DOGE dividend" at a summit in Miami. Trump explained that this was utilizing part of the 20% savings identified' by Musk's Department of Government Efficiency (DOGE), and giving it back to taxpayers. But he had not provided any further details about the potential 'DOGE dividend' and its odds since then.

When I get my tax refund?

If you electronically filed your federal taxes and provided your bank account information, then you should expect a direct deposit in your account within 21 days. If you did not provide account banking information, then it could take 6–8 weeks for a paper check refund in the mail.

Remember, filing your return is not the same as the IRS accepting your return. You know the return has been accepted if you see a "Refund Sent" message when you check your tax return status. Once you see the refund sent message, there should not be long until the funds are deposited in your account.

If the IRS processes your refund, and you selected the direct deposit option, you may see it within days hit your bank account.

How to check on my federal refund status?

The IRS has an online tool called "Where's My Refund" that allows you to check the status of your refund. Click here.

You can start to check the status of your refund within 24 hours of e-filing your return. The IRS updates refund information once a day on their website.

The online tool requires you to enter your social security number, filing status, and amount of the refund on the return. It will then reply with return received (been processed), refund approved (preparing to issue refund by date shown) or refund sent (sent to your bank or by mail).

Again, once it shows IRS has approved your refund, it could be in your bank account within days if you chose the direct deposit option.

Another way to check on the status is to call the IRS at 800-829-1954.