Tesla rises on the stock exchange: Tesla shares rise after Elon Musk's announcement about his political role

Tesla shares rose more than 5% after Elon Musk announced he would reduce his involvement in the Trump administration to focus on the company. The company reported a 71% drop in quarterly profits.

The electric vehicle company Tesla posted a 4.6% rise in trading despite a 71% drop in net profit in the first quarter of 2025. Earnings reached $409 million, lower than the same period last year. In after-hours trading, the shares rose 5%.

This market movement is attributed to Tesla CEO Elon Musk announcing his decision to reduce his political involvement starting in May. He emphasized that he will reduce his involvement with the Department of Government Efficiency (DOGE), which is linked to the Trump administration, to focus on the direct management of his company.The market responds positively to a more Tesla-focused Musk.

The market responds positively to a more Tesla-focused Musk

Musk's announcement was interpreted as a sign that the company could regain some of the momentum lost in recent quarters. Industry analysts believe the founder's direct leadership has historically been a determining factor in Tesla's innovation and performance. His political involvement had raised concerns among investors, especially after the company's negative results in recent months.

The stock price reflects this change in perception. On Tuesday, Tesla reached $237.97 per share, and in after-hours trading, it continued its upward trend. This performance demonstrates the influence that Musk's personal decisions have on investor confidence, especially in times of economic uncertainty and declining profits.

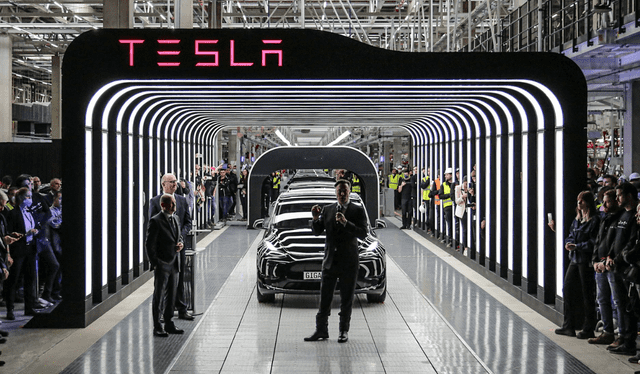

Tesla CEO Elon Musk gives talks about his electric vehicles. Photo: Bloomberg Línea

ALSO SEE: Trump replaces IRS chief: The decision stems from a dispute between Elon Musk and the treasury.

Financial results reflect a decline in vehicle sales

According to Tesla's quarterly report, revenue from car sales between January and March 2025 was $13.967 billion, representing a 20% decrease compared to the same period in 2024. This drop is linked to reduced demand and increased competition in the electric vehicle market, factors that have also affected other manufacturers in the sector.

Despite this unfavorable context, the company seeks to strengthen its market position with new product lines and an internal reorganization that will include Musk's renewed focus. The entrepreneur has previously stated that Tesla's long-term success depends on both technological innovation and consistent strategic direction, something he intends to revisit with his new availability.