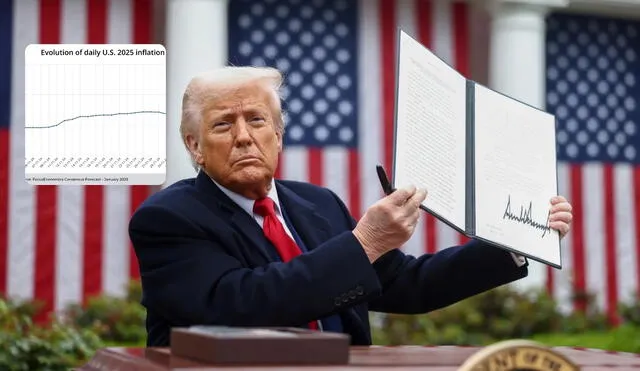

Trump's tariffs show minimal impact on inflation, surprising Economists

As Trump's tariffs raise concerns over long-term inflation, the Federal Reserve remains cautious. While April's inflation data shows limited impact, rising import costs and consumer expectations suggest potential economic challenges ahead. Stay tuned for updates on how these policies could shape the future.

U.S. inflation rose at its slowest pace since early 2021, defying predictions that President Donald Trump's tariffs would significantly drive up consumer prices. According to the Labor Department, the Consumer Price Index (CPI) increased by 2.3% annually, with core inflation—excluding food and energy—holding steady at 2.8%. Notably, prices for goods heavily impacted by tariffs, such as clothing and new cars, declined, while only some electronics and furnishings saw price increases. This data contradicts earlier forecasts that anticipated sharp price hikes due to the administration's aggressive trade policies.

The unexpected moderation in inflation has bolstered the Trump administration's claims that its economic strategies are effective. Following the CPI report, the Trump War Room posted on social media, asserting that the President's plans to unleash American energy, cut regulations, and reduce government waste are yielding positive results. Despite this, many economists remain cautious, warning that the full effects of the tariffs may not yet be reflected in consumer prices and that inflationary pressures could build in the coming months.

Fed warns Trump's tariffs may fuel inflation, cautious on interest rate cuts despite pressure

Federal Reserve officials have expressed concern over the potential for rising import costs to eventually push inflation higher. Fed Governor Adriana Kugler noted that, although some tariff rates have been reduced following a temporary détente with China, the administration's new taxes on imports remain "pretty high." She anticipates that these factors could lead to increased inflation and slower economic growth in the near future. Analysts at Citi project that the Fed's preferred inflation gauge, the personal consumption expenditures index, may climb to 3% by year-end, surpassing the central bank's 2% target.

The current inflation data may influence the Federal Reserve's monetary policy decisions. President Trump has been urging Fed Chair Jerome Powell to lower interest rates, arguing that such a move would further stimulate the economy. However, Powell and other policymakers have emphasized the need to keep inflation in check, suggesting that premature rate cuts could undermine economic stability. The Fed has thus far maintained interest rates steady, adopting a cautious approach as it monitors economic indicators.

Consumers expect higher inflation amid tariff uncertainty, Fed urges caution on long-term economic impact

Consumer expectations also reflect concerns about future inflation. A recent report from the New York Federal Reserve indicates that consumers anticipate prices to rise at a rate of 3.2% over the next three years. This sentiment underscores the uncertainty surrounding the long-term impact of trade policies on the economy. While the immediate effects of the tariffs appear muted, the potential for delayed inflationary consequences remains a topic of debate among economists and policymakers.

In summary, while April's inflation figures suggest that the immediate impact of Trump's tariffs on consumer prices has been limited, the long-term effects remain uncertain. The administration views the data as validation of its economic approach, but the Federal Reserve and many economists advise caution, highlighting the possibility of rising inflation and slowed growth in the future. As the situation evolves, both the government and the Fed will need to carefully assess the balance between stimulating the economy and maintaining price stability.