Mortgage rates hit 6.98% — yet homebuyer demand surges 18% year-over-year. Here’s what’s driving it

Despite rising mortgage rates, purchase applications jumped 2% in a week and 18% compared to last year.

Mortgage rates rose last week to their January high, but demand from prospective homebuyers still grew surprisingly. Purchase applications jumped 2% from the previous week and a whopping 18% higher than the same period in 2023, reported the Mortgage Bankers Association (MBA).

The 30-year fixed conforming rate on loan balances rose to 6.98% from the prior week's 6.92%. While rates edged higher, relief came in the form of slightly fewer points, which dipped to 0.67 from 0.69, based on loans with a 20% down payment. MBA economist Joel Kan cited an uptick in housing inventory in many markets as one of the key factors in bolstering transaction volume.

Refinancing demand drops, but yearly numbers still up

While purchase activity improved, refinance applications took a hit, falling 7% week-over-week. Conventional refinances fell 6%, and refinances of VA loans fell 16%. Refinance demand was still 37% above the same week last year, showing there are still lots of homeowners seeking better terms in light of rate volatility.

The week began with a slight drop in mortgage rates, largely due to mixed signals from the latest consumer confidence report. Mortgage News Daily's Matthew Graham explained that labor market concerns in the report pushed bond markets higher, leading some lenders to push mortgage rates slightly lower.

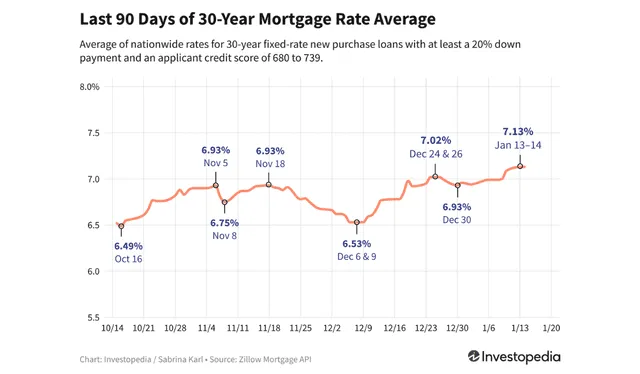

Figures show that mortgage rates will increase from January 2025. Photo: Investopedia

ALSO SEE: Say goodbye to retiring at 65: SSA raises retirement age — When can you claim full benefits?

Market outlook: Why buyers are still jumping in

Analysts point to increased supply and a possible future rate hike fear as two reasons why homebuyers remain on the move, even in a higher-rate environment. "Growing supply is giving buyers more choices, which is helping to offset the affordability squeeze from higher borrowing costs," Kan said.

As mortgage rate action remains sensitive to the broad economy — both employment marketplace performance and Federal Reserve signals — consumers and institutions alike are watching with bated breath. To date, the housing market appears to be riding out the rate storm better than expected.